Who Is Leading the Ship? People Leave People, Not Jobs

Law firms love to talk about strategy—five-year plans, aggressive growth targets, and market positioning. But all too often, these grand ambitions...

Connecting...

This last financial year has seen a total of 213 appointments made across the Big 4 through internal promotion, lateral hire or as a result of acquisition. This figure is up significantly from the FY13 with 183 appointments. We have analysed the appointments across the firms and have provided some interesting insights for each practice area. Please follow each of the links to learn more about each of the practice areas.

It is quite apparent that most of the Big 4 firms have built in sufficient succession planning strategies with 74% of this year’s intake being internal promotions. We have seen the lateral hires coming in the form of acquisitions (6%) or specialist targeted hires. This has been to either scale up practices and speed up growth, or acquiring new skill sets and industry focus to the firms.

Consulting remains top of the agenda as the Big 4 accounting firms compete using economies of scale as they strive to be all things to all clients. 65 Partners were promoted in this area double that of any other practice area. The significant growth within the Private Client arms also reflects this agenda as the Big 4 ramp up their efforts to increase their footprint into the SME space. The feeling is it is a softer market to compete against the next tier firms due to their perceived lack of breadth in their offering. 34 Partners were promoted within these Private Client divisions, 35% of which came from whole firm acquisitions.

Taxation also featured a large number of appointments (36), with a fair spread across most disciplines. Surprisingly, promotions within R&D Tax equalled that of the more traditional Corporate and International Tax practices. The growth in R&D practices (with the added benefit of changes in legislation) was due to being able to take advantage of success related fee structures and gain exponential returns on their effort.

Audit and Assurance proved resilient in its appointment of partners. 31 Partners across the firms is a fair effort given the pressure firms are facing in regard to keeping audit practices profitable without accepting too much risk. Audit promotions tend to be a good gauge of the core performance of the firms. It is an indicator of sound succession planning strategies and consistent performance.

We have also provided some commentary on the Top 10 firms in the market as we find the contrast to the Big 4 interesting. The mid tier is always a volatile space with the general consensus being that more consolidation is required. With a general lack of scale in comparison to the Big 4, it is a challenge for them to rely solely on succession planning to maintain their performance, their need to acquire lateral partners is more apparent than ever. In contrast to 74% promotion rate amongst the Big 4 firms, 63% of all partner announcements in the mid tier were from lateral hires.

The Internal Audit and Risk markets remained sound in their progression. The 12 partner appointments were less than many of the other practices, though in the middle of the cycle of in-sourcing, many firms are finding strong growth prospects a challenge.

The Forensics practice area had a small increase in partners relative to the other areas (three), though it was still up on last year.

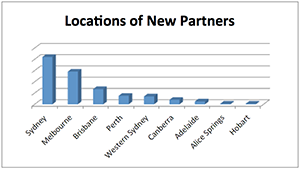

Sydney remains the dominant location within Australia for partner appointments. Whilst expected, the magnitude of the difference (30%) surprised us.

Given Deloitte’s strong use of their salaried partner role, they remained the firm with the most number of appointments. With some of the other firms now considering how they could also use a fixed share partner to facilitate their growth needs. Unsurprisingly, Deloitte also had the most amount of lateral hires appointed either independently or as part of an acquisition.

We do not foresee much change occurring through the year in terms of the trends mentioned above. We may see the frenetic pace of investment in the consulting practices slow, more for the need to consolidate historic acquisitions. We also see a challenge in maintaining a consistent brand and culture with so many differing skill sets and client focuses. We feel more investment in the Private Client practices will continue, with focus being on geographical expansion. Our third prediction will be growth through Corporate Finance practices of the firms, with deal flow increasing and general infrastructure activity continuing to be topical.

I hope you have found the information useful and interesting. As a firm, we were instrumental in a number of the lateral hires mentioned and hope to continue assisting firms with their growth plans. With a dedicated team of practice area specialists, we have significant insight in to the market and provide a range of services to firms looking for growth or people strategies.